The annual healthcare conference hosted by JPMorgan Chase & Co. in San Francisco, which will end on Thursday, has long been regarded as the industry’s flagship event. Executives gather to set goals for the coming year or to make preparations behind closed doors. It’s a platform for announcing agreements or closing them.

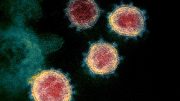

The event, now in its 40th year, was forced to go virtual for the second January in a row after the omicron variety triggered a spike in coronavirus cases. While there was less mingling over cocktails and more peering at laptops as a result, the health sector’s favorite crystal glass still has plenty to offer.

Here are five key points to remember:

Rna is having a good time.

Those in the pharmaceutical industry’s higher echelons are continually asking themselves, «How do you not miss the next great thing?» The messenger RNA technology powering Pfizer Inc. and Moderna Inc.’s Covid-19 vaccines was the focus of this year’s conference.

On Monday, Pfizer announced a pair of minor transactions to help it advance its mRNA product development. According to Chief Executive Officer Albert Bourla, the technique could be used to treat infectious diseases, uncommon diseases, and cancer. Drug candidates based on the information-carrying portion of cells have also piqued the interest of other prominent pharmaceutical organizations. Through a new RNA agreement, Amgen Inc. could possibly pay billions to Arrakis Therapeutics Inc., while Eli Lilly & Co. and Johnson & Johnson have acknowledged they’re keeping an eye on the burgeoning area for assets.

Megamergers are being replaced by partnerships.

Megadeals were conspicuously absent from the conference for yet another year. Instead, pharmaceutical behemoths such as Pfizer, Amgen, and Bayer AG have turned to partnerships. Such agreements allow large corporations to experiment with interesting but unproven technology without risking a large investment. «Partnerships will provide us exactly what we want without committing the kind of resources that would be required if we wanted to acquire the companies,» Bourla added, citing Pfizer’s success with vaccine partner BioNTech SE as an example. While R&D and commercialization agreements provide much-needed funds to tiny drugmakers, they may not deliver immediate gratification to investors who want to see hot new brands bought up at a premium.

The pandemic is still the focus of attention.

The United States reported more than 1.4 million new viral infections on the first day of the conference, the highest daily count of any country in the globe. The number of hospitalizations and deaths is likewise on the rise.

The startling comeback of Covid has prompted health-care providers to scramble to create new instruments. Pfizer’s Bourla talked about progress on a «hybrid» Covid vaccine that will target both omicron and the original virus this week, while Moderna announced $18.5 billion in vaccine orders for this year. Novavax Inc., a late-to-market company, announced that the first doses of its Covid-19 vaccine had been transported to Europe, where it was cleared last month.

On the therapeutic front, Regeneron Inc. announced that it will begin clinical trials for an omicron-fighting antibody this quarter, and Gilead Sciences Inc. stated that US regulators may soon approve a shorter course of its Covid medication remdesivir for use outside the hospital. Novartis AG is developing its own medicine, and Vir Biotechnology Inc. and GlaxoSmithKline Plc announced on Wednesday that the US government has decided to purchase another 600,000 pills of its Covid medication sotrovimab.

It’s not business as usual for these pharmaceutical companies. Investors, on the other hand, continue to see potential in next-generation products to combat omicron and other future varieties of concern.

The patent cliff continues to exist.

Starting in 2028, Merck & Co.’s cancer medicine Keytruda, which took in $14.4 billion in sales in 2020, will face cheaper competition. Revlimid, a medicine for multiple myeloma, and Abraxane, another profitable cancer therapy, face additional risks starting in 2022 for Bristol Myers Squibb Co. Revlimid, which Bristol acquired when it purchased drugmaker Celgene in 2019, became the company’s top-selling medicine the following year, with revenues of $12 billion.

These changes, dubbed «LOEs» in industry vernacular (short for loss of exclusivity), were the focus of both companies’ presentations this week. In the years ahead, executives discussed their ambitions to recover lost revenue with new treatments in areas such as cancer, as well as through business expansion.

Merck is a pharmaceutical company «will remain science-driven and unconstrained by therapeutic area, but will be conscious of the need for a more balanced portfolio over time. All of this is being done to ensure that we can successfully manage the likely biosimilar competition to Keytruda later this decade «In his opening remarks on Monday, Chief Executive Rob Davis remarked.

The nature of conferences has evolved (maybe for good)

The JPMorgan Healthcare Conference feels like any other investor meeting these days without the energy in the corridors of the Westin St. Francis and around San Francisco’s Union Square. Deals may be made from anywhere, at any time, as the epidemic has demonstrated. Investors can watch presentations from the comfort of their own homes. Will people still be prepared to pay for a pricey annual journey if Covid relents?

The Novartis Institutes for BioMedical Research’s global head of commercial development and licensing, Philip Gotwals, believes that enthusiasm for the conference—and others like it—has faded. In an interview, he remarked, «The genie is out of the bottle now, and it’s going to be very difficult to put back.» «People are going to modify how they think.»

Whenever, and if ever, the conference returns, the exhilaration of meeting in person can re-energize it.

Be the first to comment on "A summary of a health summit: RNA is hot, but mergers aren’t"